401(k) Savings Advantages

Save More with a 401(k).

Most experts suggest you'll need to save 10-15% of your income1 over a 40-year career to live comfortably after you leave the work world behind. Sure, you could open an IRA or other type of retirement savings account, but you'll likely be able to contribute far more to your nest egg with a 401(k) while enjoying additional tax and investing benefits too.

Higher Contribution Limits Than an IRA

Currently, federal laws limit IRA contributions to just $7,500 per year. With a 401(k), you can contribute as much as $24,500 per year. If you're 50 or older, you're allowed to make an annual "catch-up" contribution of $8,000. That's as much as $32,500 per year you could save for retirement.

401(k) Advantages Over a Traditional IRA

| 401(k) | IRA | ||

|---|---|---|---|

| Employee Contribution Limit (2026) | 401(k)

$24,500

| IRA

$7,500

| |

| Employee Limit with Company Match or Profit Share | 401(k)

Up to 25% of W-2 payroll with a cap of

$72,000 | IRA

N/A

| |

| Roth Income Limit | 401(k)

None

| IRA

$168K*

| |

| Penalty-Free Access if Needed | 401(k)

Yes, via loan

| IRA

No

| |

| Age 50+ catch-up amount in 2026 | 401(k)

$8,000

| IRA

$1,100

| |

The maximum contribution for an employee participant in 2026 is

$24,500 ($32,500 if 50+ years of age).

*In 2026, the contribution amount allowed begins to decrease at $153K for single

individuals, hitting $0 at $168K. For those filing jointly the

contribution limit begins to decrease at $242K, hitting $0 at $252K

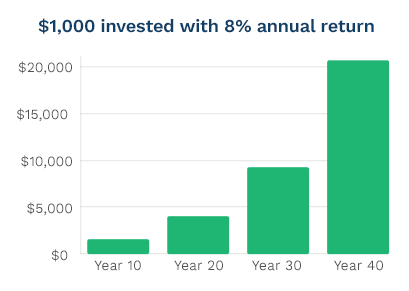

Compounding Can Really Help Your Savings Add Up

Because earnings in a 401(k) plan compound via market growth, dividends and/or interest, over time your money can grow in an exciting way. In the hypothetical example shown here, you can see how $1,000 could turn into $20,000 over a 40-year career.

This example compares how a one-time investment of $1,000 can grow over time assuming an 8.0% fixed annual rate of return. Your account may earn more or less. This is a hypothetical example only, and not a guarantee of future returns. Actual experience will vary with portfolio selections and changing market conditions. The total account balance does not take into account federal and state income taxes, which will be due upon withdrawal. Assets withdrawn before 59½ may incur a 10% tax penalty.

Employer Matching and Profit-Sharing Options

With a 401(k), most companies choose to provide some contribution to employees via a match or a profit share. Contrary to popular belief, your company is not required to offer employees a matching contribution program with your 401(k) — it's an option. But if you decide to offer your employees a 401(k) match or profit-share, you will also receive it (alongside a corporate tax deduction for your business). Deciding whether to provide a match and determining how much to match is typically more of a cash flow decision for most businesses.

Note that owners' and key employees' personal contributions may be limited in the absence of a match or Safe Harbor plan.

Access to Money in an Emergency

Here's another benefit you don't get with an IRA: access to your money when you really need it, with no penalties or high interest rates.

Of course, you don't want to remove money from your retirement savings unless it's truly necessary as it can hurt how much you build for retirement. However, with a 401(k) you can have the option of taking a loan. If you enable this feature, you or any of your employees can take a loan of up to 50% of the vested 401(k) account balance up to the maximum amount of $50,000. You will contribute back to your account to pay down the loan typically over a 5-year period. Even the interest you pay on the loan goes back into your account.

Warning: if you were to leave your job, the amount outstanding on your 401(k) loan is typically due within 30-60 days. If you are unable to pay this amount, the amount that remains unpaid will be considered income and taxed at your current tax level plus a 10% penalty. Those over 59 and a half years of age typically are not subject to the tax penalty.

1 Industry experts generally agree that, depending on when you begin contributing, a minimum contribution of 10-15%, will be necessary to reach a goal of 8 to 10 times your ending annual salary prior to retirement. You may want to review your current contribution level to determine whether you believe it is sufficient to meet your retirement goals. There is no guarantee that contributions at this level will result in sufficient funds to meet those goals.